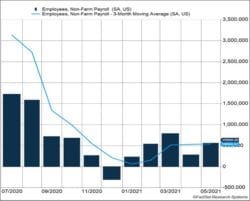

U.S. nonfarm payrolls rose 559,000 last month (Figure 1). This is much better than last month’s 278,000, but much lower than March’s 785,000 gain. Workers are returning to the labor force more slowly than expected. Businesses are reporting challenges in finding workers. Leisure and hospitality employment accounted for more than 50% of the job gains. Auto industry employment dropped 27,000 last month as semiconductor shortages forced plant shutdowns.

Key Points for the Week

- S. nonfarm payrolls rose 559,000, missing expectations of 650,000.

- Unemployment fell to 5.8% from 6.1% as individuals who had stopped looking for work have been slow to return to the labor force.

- The slow return pushed average hourly earnings 0.5% higher than the previous month.

Unemployment fell to 5.8% due to job gains combined with a drop in the number of people looking for work. Average hourly earnings rose 0.5% as the labor shortage boosted salaries.

Markets saw the gains as good enough to feel confident about the economy and weak enough that interest rate hikes remain far off. The S&P 500 added 0.6% and is now up more than 13% this year. Global stocks benefited as the MSCI ACWI Index gained 0.8%. The Bloomberg BarCap Aggregate Bond Index inched up 0.1%.

Next week, the focus returns to inflation. The U.S. and China will release their Consumer Price Index data. China will also publish its Producer Price Index report, which reflects the cost of goods from manufacturers. Additional price increases from manufacturers could be a warning sign of future price hikes for consumers.

Figure 1

Better, But Not Good Enough

The U.S. jobs market isn’t recovering as quickly as anticipated. The initial report for March indicated 916,000 jobs were created. Expectations for April were for more than a million; yet, the report fell far short. March has since been revised down to 785,000 jobs, and April’s revised gains remain below 300,000. Adding 559,000 jobs in May reflects an economy recovering at a slower pace than many expected (Figure 1).

The pace of job gains matters a lot. If the economy were to add 900,000 jobs, employment would reach its February 2020 peak in early 2022. If gains average 500,000 per month, the economy would not reach the February 2020 employment level for two years. Our expectation is job growth will gradually slow as more of the previous jobs are recovered. Gains of 500,000 a month now likely mean slower gains in the future.

The decline in unemployment from 6.1% to 5.8% was driven by more workers being hired combined with a small reduction in the number of people working or seeking jobs. The labor force now includes 3.5 million people fewer than it did in February 2020.

Efforts are expanding to increase the number of available workers. Many states have eliminated the $300 per week additional unemployment benefit. Some states are offering bonuses to lure people back to work. Other states are yet to reopen fully. Large cities, such as New York, Chicago, and Los Angeles, are planning to reopen more fully in June.

Employers are raising wages to encourage people to get back to work. Average hourly earnings jumped 0.5% in one month. Some question why employers don’t raise rates faster, but employers are looking for a certain profit level and raising wages eats into that margin. Companies have organized the business around wages and are reluctant to raise them for a short-term gain that may have a negative long-term impact. It is harder to cut wages once they have been raised. Larger forces are also at work. COVID forced people to reassess their lives. Some are making choices to scale back on spending to emphasize different values.

The likely result is a new balance will gradually be attained. Wages seem poised to increase faster than in previous years. The elimination of additional unemployment support will also push people back into the job market as those payments subside and the money from government checks is used up. Businesses will rework their operations to use fewer employees, and unvaccinated people getting vaccinated will help people feel safe returning to work.

In the end, the recovery seems likely to march on as long as the virus remains under control. The data indicates the march will be longer and at a slower pace than many had hoped.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.cnbc.com/2021/04/02/us-jobs-report-march-2021.html

https://www.bls.gov/news.release/empsit.nr0.htm

Compliance Case # 01052158