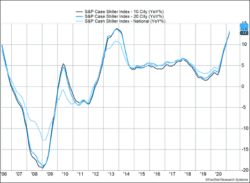

U.S. home prices continued to march higher. As Figure 1 shows, they have surged 13.2%. The 20-city index has increased slightly more as cities just out of the top 10, such as Phoenix, San Diego, and Seattle have experienced very rapid price appreciation. The annualized gains are in line with the 2013 peak as housing prices recovered after the financial crisis. During that rally, the 10- and 20-city indexes experienced more rapid gains than the overall index, indicating smaller cities and towns didn’t participate at the same rate. In this rally, the move toward smaller towns has boosted the national index above the 10-city index.

Key Points for the Week

- S. home prices surged 13.2% over the previous year, even though mortgage rates increased in the first quarter.

- Personal income fell 13.1%, and disposable income fell 14.6%. Income dipped sharply because the previous month included a large stimulus. Employee compensation rose 0.9%, reflecting growing employment.

- The PCE Price Index rose 0.5% and has now increased 3.6% over the last year. Core prices, which exclude food and energy, increased 3.1% over the same period.

In other economic news, personal income fell 13.1%, and disposable income dropped 14.6%. The drop occurred because the previous month’s data reflected the latest government stimulus. More importantly, employee compensation rose 0.9% in one month as more people returned to work and wages moved higher to lure reluctant former employees back to their jobs.

Inflation rose 0.5% last month, based on the PCE Price Index. Shortages of semiconductors and other inputs are pushing prices higher for key goods. Inflation is expected to moderate as the year-ago comparisons move past the period of very stringent lockdowns and supply chain challenges moderate.

Markets returned to rally mode. The S&P 500 jumped 1.2% last week. The global MSCI ACWI index gained 1.4%. The Bloomberg BarCap Aggregate Bond Index added 0.3% of last week’s decline. In May, the S&P 500 gained 0.7% and the MSCI ACWI added 1.5%. The Aggregate Bond Index edged 0.3% higher.

The U.S. employment report will be this week’s headline. After an extremely disappointing report last month, a return to rapid job gains is a key part of the U.S. recovery plan.

Figure 1

Looking Back and Around

The Memorial Day holiday is always special, as we take time to acknowledge the men and women who died protecting our country and, more broadly, the people who came before us in our families. This year, more people are grieving the loss of a family member or friend, and our thoughts and prayers go out to you.

Based on the success of U.S. vaccination efforts, this Memorial Day also represented a transition to a reopened America. People got back on the move and celebrated with friends and family not seen in person for months. When looking at their lives compared to one year ago, things are getting better for many Americans. Investors have already celebrated many of the victories against COVID as markets are only effective when they are looking ahead, so much of the future good news has been discounted.

Memorial Day also serves to remind us that Americans can get too self-focused and lose track of key events in the world that may become issues at home. Anyone who has visited the American cemetery in Normandy knows world events can affect our country in profound and tragic ways.

International markets offer a few points of key concern. Vaccination efforts in other countries have trailed the United States, and that has left them vulnerable to outbreaks and variants. A variant of the virus in India has caused a surge of cases in that country. At one point, India was reporting nearly 400,000 cases each day. Australia’s social distancing efforts have been very successful throughout the pandemic, but its vaccination efforts have lagged. Less than 10% of Australians have been fully vaccinated. Australia’s second most populous state recently announced a snap seven-day lockdown as new cases increased. These lockdowns are important to the recovery and prices. In the global supply chain, a lockdown in one place can disrupt entire industries.

International political incidents are also a risk we are watching. On May 23, Belarus forced a commercial flight between Greece and neighboring Lithuania to land when the plane was over its airspace. A 26-year-old journalist who had shown videos of protests against the Belarusian president was removed from the plane. Belarus’s staunch ally, Russia, has been linked to computer hacking attempts.

Trade friction seems to be increasing even as supply chains are stretched. Lumber price increases have raised the cost of new homes in the U.S. Yet, the Biden administration announced plans to raise the Canadian timber tariff from 9% to 18%. The new administration has left in place the tariffs President Donald Trump put on China. With inflation rising, it seems government policies may contribute to the increases.

As America continues to progress toward more freedom of movement and association, keeping a focus on the challenges abroad can keep your portfolio better balanced. The risks can also represent opportunity. One bright spot: Widened availability of vaccines in other countries can contribute to faster growth overseas and more trade opportunities for American companies.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://graphics.reuters.com/world-coronavirus-tracker-and-maps/countries-and-territories/australia/

https://www.wsj.com/articles/u-s-manufacturers-blame-tariffs-for-swelling-inflation-11622367001

https://www.bea.gov/news/2021/personal-income-and-outlays-april-2021

Compliance Case #01047656