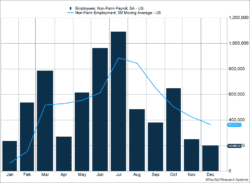

The employment report released last week may have raised more questions than it answered. The establishment survey, which surveys businesses, showed only 199,000 jobs were created, missing expectations of 400,000 (Figure 1). The household survey gave a very different picture. Unemployment fell to 3.9%, employment rose by 650,000, and 170,000 people joined the labor force. The gap is partly reconciled by reports new businesses are being formed at a rapid pace and the usually more accurate establishment survey isn’t keeping up with the underlying changes.

Key Points for the Week

- The two major employment surveys continue to produce different results. The establishment survey reported businesses and other establishments created only 199,000 jobs and missed expectations of 400,000.

- Meanwhile, a survey of households estimated employment grew by 650,000 jobs and the unemployment rate fell to 3.9%.

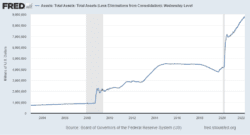

- Federal Reserve minutes indicated support for shrinking the balance sheet quicker than expected, and growth stocks lagged value stocks to begin the year.

The report of the Federal Reserve’s minutes last week provided some answers, and investors didn’t like them. The Fed communicated it would likely allow its balance sheet to shrink shortly after the first interest rate increase. After the global financial crisis of 2008-2009, the Fed didn’t reduce its balance sheet until two years after first raising rates (Figure 2).

Stocks reacted negatively to the news. The S&P 500 index shrank 1.8% last week, with most of the losses occurring the day the Fed released its minutes. The MSCI ACWI lost 1.5%. The Bloomberg U.S. Aggregate Bond Index declined 1.5% as a quicker balance sheet reduction means the market will have to absorb more debt and rates may rise. Inflation data and retail sales headline this week’s key data releases.

Figure 1

Confusing Reports and Some Fed Clarity

2022 looks like it might be a more volatile year. Stocks were down for the first week of January, and the S&P fell 1.9%. The decline was caused primarily by adjustments to Fed policy, although investors with gains waiting to sell in a new tax year may have contributed. Stocks performed quite differently based on style and sector. The Russell 1000 Value Index climbed 0.8% last week. The Russell 1000 Growth, which emphasizes faster growing stocks, fell 4.8% as key sectors such as technology and health care both declined sharply.

The U.S. employment report, released later in the week, provides insight into the economy the Fed is trying to tame. The December report was released Friday and, while the headline number of new jobs was below expectations, the report included good news for the job market. According to the establishment survey, December nonfarm payrolls increased by 199,000, which was below expectations of 400,000. This miss can be attributed to a lag in hiring in leisure and hospitality, likely caused by the powerful Delta and emerging Omicron variants. However, payrolls from the previous two months were revised upward and capped off a year where 6.4 million jobs were created, a record for the U.S. economy.

The household survey told a better story as the unemployment rate fell to 3.9% versus expectations of 4.1%. Even better news is the unemployment rate fell because more people were hired, not because people dropped out of the labor force. Employment rose by 650,000 and the labor force grew by 170,000. The differences between the two surveys can partly be attributed to increased self-employment. New business applications are 55% higher than two years ago, and the usually more accurate establishment survey misses that growth. Last month’s report showed a similar gap and serves to remind us that surveys are approximations of a vast and complex economic system.

Figure 2

The Fed is responsible for trying to manage all this complexity. The minutes from its last meeting included some new information that pressured growth stocks in particular. In its latest meeting, Fed officials indicated they would likely reduce the balance sheet more aggressively than the past economic cycle. Figure 2 shows the Fed didn’t start decreasing its balance sheet in a meaningful way until 2018. The decision to wait years after the first interest rate hike to start adjusting the balance sheet meant it was elevated when the pandemic hit. Since then, it has continued to climb.

Rather than wait after raising rates, the Fed seems more likely to start reducing its balance sheet soon after the first hike. That way, the Fed can avoid having short-term rates increase because of rate hikes while long-term rates stay low because the Fed owns so much of the supply. Higher long-term rates affect growth stocks more because more of their earnings are generated farther into the future and interest rates affect how much those earnings are worth today.

All of this points to the Fed raising rates at its March meeting, which would align with the end of the newly accelerated tapering program. Then the Fed will start the slow reduction of its balance sheet and raise rates two or three more times this year. Chair Jerome Powell has said the aim is to get to full employment. At 3.9% unemployment, it’s likely the economy is close.

–

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

Russell 1000 Growth

The Russell 1000® Growth Index measures the performance of the large cap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years).

Russell 1000 Value

The Russell 1000® Value Index measures the performance of the large cap value segment of the US equity universe. It includes those Russell 1000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years).

https://research.ftserussell.com/Analytics/FactSheets/temp/54ab8d2d-6ee7-4e38-9b73-bbf48317b56a.pdf

https://research.ftserussell.com/Analytics/FactSheets/temp/49d10b88-0dc5-4fa2-9085-f98cb56fe6c8.pdf

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20211215.pdf

https://www.bls.gov/news.release/empsit.nr0.htm

https://fred.stlouisfed.org/series/WALCL#0

Compliance Case #01237863